In finance, short selling or “being short” of a stock, a bond or a currency means that the investor has a negative view on the future price of the asset and positions him/herself to make a profit from any future fall in price.

Assets can fall in value (price) for many reasons but usually it is a result of worsening prospects for the company/asset itself, that may be macro-economic (what’s happening in the global or national economy), it may be sector (the industry the stock is in) or down to the individual circumstances the company finds itself in (competitive pressures/poor management/lack of resources etc).

So why “Football Shorts”?

Football is (despite the claims of many involved in running football) a relatively simple business. It has a small number of income sources, easily defined costs and like most businesses an ongoing working capital requirement to fund the acquisition of assets (players), have reserves to meet losses when they occur and perhaps every few decades, fund new premises (stadium/training facilities) or the development of existing premises.

Broadly, a synopsis of the financial affairs of a Premier League football club would look like this:

| Turnover/Income | Expenses | Capital Requirements |

| Matchday | Wages | Working capital |

| Broadcasting | Other operating costs | Player acquisition |

| Commercial | Financing costs | Funding of Stadium/training ground development/construction |

| Sponsorship | Amortisation of player transfer costs | |

| European | Depreciation of assets | |

| Player trading* (key to the Profit & Loss account but not part of turnover) | Exceptional costs | |

| Tax |

The Premier League has boomed for many years. Going back to 1992, the growth in turnover is clear, rising from £205 million to more than £5.16 billion in the last complete season (annualised growth of 13% p.a.over the whole period):

However as income has risen, expenses have risen also. As is widely recognised, the biggest expense in the Premier League is wages. Total wages have grown from £97.1 million (no tittering at the back please) to £3.14 billion (annualised growth of 14.3% p.a. over the whole period) . By another measure, from 47.3% of turnover to 60.8%.

Wage costs have grown even faster than the increase in income – we can return to this later as much of this differential has been funded by asset (player) sales.

Analysing Turnover

As mentioned above, the key elements of turnover are match day income, Broadcasting revenues, commercial revenues & sponsorship.

Matchday revenues

Matchday revenues have grown steadily over the history of the Premier League. In 1992 total matchday revenues were £89 million and in the last complete season (2018/19) that had risen to £678 million – an annual growth rate of 7.5%

As a percentage of overall revenues, matchday revenues have reduced over time, Whilst still significant, they now represent 13.3% of the total revenues generated by Premier League Clubs.

Impact of no games in front of spectators

Currently 25% of the season remains unplayed with no prospect of matches if played, being played in front of paying spectators. Assuming that clubs refund all season ticket revenues and taking into account away and walk up tickets not sold that amounts to a loss of revenue of £132 million (based on last year’s figures).

In a worst case scenario where no games are played in front of paying spectators for the whole of the next season, total lost revenue would amount to nearly £800 million (using season 18/19) figures, ranging from £128 million for Manchester United to £6.1 million for Burnley. Tottenham Hotspur would lose an estimated £115.8 million plus revenues from the non-football use of their new stadium.

| £ millions | Lost matchday t/o (2019/20) | Whole season 20/21 | Total |

| Manchester United | 17.0 | 110.8 | 127.8 |

| Tottenham Hotspur | 15.8 | 100.0 | 115.8 |

| Arsenal | 12.8 | 96.2 | 109.0 |

| Liverpool | 12.5 | 84.2 | 96.7 |

| Manchester City | 12.2 | 55.0 | 67.2 |

| Chelsea | 8.1 | 66.6 | 74.7 |

| West Ham United | 6.2 | 27.1 | 33.3 |

| Newcastle United | 5.7 | 23.9 | 29.6 |

| Brighton & Hove Albion | 4.2 | 18.5 | 22.7 |

| Southampton | 3.4 | 17.0 | 20.4 |

| Everton | 3.2 | 14.2 | 17.4 |

| Leicester City | 2.8 | 14.7 | 17.5 |

| Crystal Palace | 2.1 | 10.9 | 13.0 |

| Wolverhampton Wanderers | 2.0 | 11.5 | 13.5 |

| Watford | 1.9 | 8.0 | 9.9 |

| Burnley | 1.1 | 5.6 | 6.7 |

| Bournemouth | 1.1 | 5.0 | 6.1 |

| 3 promoted teams | 6.5 | 25.9 | 32.4 |

| Total | 118.6 | 695.1 | 813.7 |

Broadcasting revenues

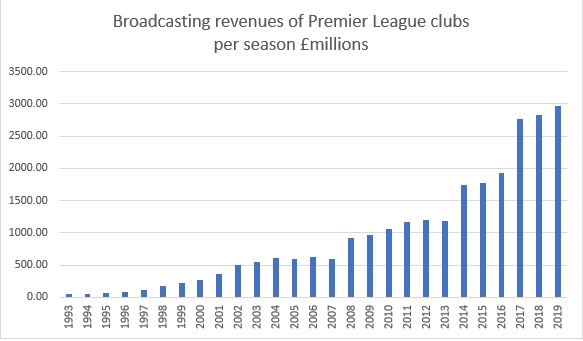

Broadcasting revenues have been the principal revenue growth driver, as the following chart show:

In the 26 years of Premier League football, revenues have grown at an annualised rate of 17%. Initially the growth was funded by competition between the domestic broadcasters, but in recent years revenue growth has been achieved through the aggressive selling of broadcasting rights overseas. Overseas rights were acquired for an aggregate of just £40 million in the first round 1992-1997. By 2016-19 they had grown to £3.1 billion, and an incredible £4.2 billion for the current 2019-2022 round.

Domestic payments fell in the last round, from £5.4 billion to £5 billion and even prior to the Covid-19 situation were expected to fall further in the 2022-25 round. Market leading analysts such as Claire Enders, forecast 12 months ago a further 20% fall in domestic right payments, despite more games being offered to broadcasters. One can only assume that figure today would now be viewed as highly optimistic.

For me, my primary concern is with overseas rights. Currently accounting for 45% of broadcasting revenues, both the number of broadcasters carrying rights and the amounts they will pay will drop significantly in the next bidding process (if not during this cycle). The impact of the Covid-19 crisis on the global economy with a very severe recession and slow recovery will see some of the weaker broadcasters disappear from the market, will see a reduction in subscribers (both personal and commercial subscribers) and a reduction in advertising expenditure. All of which will result in an enormous retraction in rights spending.

For ease, I’ve assumed similar falls in revenues for both domestic and overseas broadcasters. In practice I expect overseas rights to fall more quickly than domestic.

| £ millions | UK rights | Overseas rights | Total | Shortfall over 3 years | Average per PL club per season |

| 2019-2022 | 5,000 | 4,200 | 9,200 | ||

| 2022-2025 | |||||

| -20% | 4,000 | 3,360 | 7,360 | -1,840 | -30.67 |

| -30% | 3,500 | 2,940 | 6,440 | -2,760 | -46.00 |

| -40% | 3,000 | 2,520 | 5,520 | -3,680 | -61.33 |

| -50% | 2,500 | 2,100 | 4,600 | -4,600 | -76.67 |

A 40% fall would see the larger clubs losing £200 million plus over three years and the clubs lower down the league in excess of £135 million.

Some point to the further involvement of the internet giants, Amazon and perhaps the OTT providers. Whilst I expect that they buy more of the rights packages, I do not see this resulting in higher revenues for the Premier League.

European revenues have become hugely significant to the top 5 clubs with UEFA rewarding clubs whose domestic broadcasters have paid the highest rights figures.Competition in previous years between Sky & BT pushed the English rights bids to record levels. In the last round BT Sport continued to bid at extra-ordinary levels, paying £1.2 billion for the latest 3 year deal. However, UEFA could only command this amount by offering increasing numbers of games. The value of individual games is falling (as with domestic football) even at the top of the Bull market cycle. Post Covid-19, the 2022 bidding will look very different.

Commercial and Sponsorship

The doyen of the modern sports business, Mark McCormack had a simple philosophy when negotiating commercial and sponsorship arrangements. If one of his clients’ career or in the case of a team, their performance, was on an upward trajectory, relatively short contracts were negotiated. Someone at the top of their game, the strategy was to negotiate long term contracts which protected against a future fall off in performance. To an extent that is the case in the Premier League with the most successful clubs negotiating long term contracts with shirt sponsors and kit/apparel manufacturers.

Expiry of existing contracts, length of existing contracts and the strength of sponsor or commercial partner (combined with their business sector and operating locations) will play a big part in determining the quantum and the security of future payments to Premier League clubs.

Unsurprisingly, as a generalisation, the biggest clubs have the stronger, most robust commercial partners and sponsors. Thus the strongest clubs will be less likely than the weaker to see an immediate impact on the majority of their income. However, as I’ve stated previously, almost without exception, every partner is dependent upon consumer spending, much of which might be viewed discretionary.

The major kit/apparel manufacturers (Nike and Adidas, in particular) have spent increasing sums in recent years to secure the highest profile clubs in the Premier League. Whilst an element of this is associated directly with shirt and other club related merchandising sales, primarily for both Nike and Adidas this is viewed as marketing or promotional spend, extending their company brand and corporate profile over expanding international markets. In benign or developing market conditions this is a wise strategy, both organisations increasing market share in growing markets. Covid-19 puts a stop to that. Market conditions are going to be extremely tough for many years ahead. Will that impact revenues currently paid to the major football clubs? It will depend of course, on the contracts, but for sure, deals incentivised on volume or future growth will pay significantly less than previously considered business plans would have suggested. Liverpool’s new deal with Nike is heavily incentivised for growth. Projected annual rewards of up to £100 million were based on future sales. The guaranteed element (around £30 million p.a. is less than the guaranteed element from existing providers New Balance.

The following charts show the size and duration of kit/apparel deals and the major shirt sponsor deals. Simply, the lower left corner shows lower income and shorter tenure of deals.

For kit deals, several points to note. As expected the largest clubs are higher and to the right of the chart (evidence perhaps of superior strategic planning?) Also each of those deals are with multi-billion dollar turnover companies (2018 figures Nike $31bn, Adidas $21 bn and Puma $4.65 bn). Compare that with Umbro (shirt suppliers to Everton, Bournemouth, Burnley, and West Ham) whose parent company reported annual turnover of $225 million in 2017 and $187 million in 2018.

Given the turbulent nature of markets in the Covid-19 crisis, clubs having to announce new deals in the short term (Everton are expected to leave Umbro next month) will almost certainly have difficulties replicating or improving existing deals.

Main shirt sponsors is a really interesting field. Everton, Bournemouth, Aston Villa, Newcastle United and Chelsea have deals expiring next month. Chelsea have confirmed a 5 year deal with telecoms firm Three – this was announced in January prior to the outbreak of the crisis (ex China). Everton currently have not announced their replacement for Sportpesa, although sources suggest another gambling company at a significant discount to the concluding Sportpesa deal. Similarly, Aston Villa, Bournemouth and Newcastle United have made no announcements. With the exception of the possible but increasingly unlikely takeover of Newcastle United, none of these clubs can expect an improvement in future terms.

In terms of looking at the security of future income it is clear that length of term is important, but equally the size and strength of the sponsor or commercial partner. With the honourable exception of Brighton and their Amex deal stretching to 2031 none of the smaller clubs have secure long term revenue from sponsorship. Indeed the reliance on gambling companies may result in further sponsor deals being cut short. Companies such as M88, W88, Lovebet, ManBetX, Fun88, Sportsbet.io pay close to £70 million a year in sponsorship to Premier League clubs – is it realistic that that can continue?

Although not detailed in this article, clubs rely upon a multitude of smaller deals, often regional by nature, to further boost their coffers. A severe global recession will significantly reduce the number and size of future deals.

Player trading profits

Despite the huge growths in income as seen above, player trading is a key part of major football clubs’ financial strategy. In a bull market with increasing player values fueled by increased revenues flowing into the game (football’s equivalent of quantitative easing, although sadly before the crisis not after) the amount clubs were prepared to pay for players just kept increasing. As a result clubs could effectively balance the books by selling players periodically for sums greater than their book value.

| Player trading profit seasons 2013-19 £ millions | |

| Chelsea | 412 |

| Liverpool | 292 |

| Arsenal | 224 |

| Everton | 224 |

| Southampton | 213 |

| Tottenham Hotspur | 172 |

| Manchester City | 153 |

| Leicester City | 148 |

| Norwich | 99 |

| Newcastle United | 97 |

| Manchester United | 85 |

| West Ham United | 80 |

Clearly for some clubs, player trading is particularly important. Chelsea, Liverpool, Arsenal, Everton, Southampton and Tottenham Hotspur have used this method to maximise expenditure whilst maintaining compliance with profit & sustainability rules in the Premier League and Financial Fair Play in European competitions

Player trading profits are relatively easy to maintain in a rising market. However, if player values flatten out, or as projected in a post Covid-19 environment fall, and some commentators suggest significant reductions, particularly in older player values, then this source of funding and profit will disappear very quickly.

Transfer activity will reduce in the short term. Partly due to cash considerations, partially due to uncertainty over future abilities to generate cash but also because players on existing generous contracts may not be able to find a new club willing to meet previous contract values. All of these factors will place significant pressure on future player trading profits.

All revenue streams under pressure

To conclude the analysis of future turnover and player trading profitability, all Premier League clubs will face extreme pressures in the near and medium term. Aside from the loss of matchday revenues for the remainder of this season, the primary concern may be the potential cash penalties imposed by broadcasters for the failure of the Premier League to deliver its product already paid for.

However, that is only the beginning of the story, the potential for the whole of next season to be played behind closed doors, the uncertainty of some broadcasters, sponsors and commercial partners to continue existing contractual obligations, the likely reduction in new commercial contract values and a significant reduction (if not complete destruction) of future player trading profits in the next few future seasons paints a bleak picture for a group of clubs/companies who failed to profit and make reserves in the good times.

The old way of running a football club is finished. The old way of being rewarded as a participant in football is drawing to a close. Has the mentality changed yet within football? I doubt it very much.

Hence football shorts……

Part II can be found here.

Categories: Everton finances

Hi not sure I agree that ‘the old way of running a club is finished’. Surely it will remain the same with a blip whilst it reviews changes to the various income streams and expenses. They are businesses like in other industries and once they understand the implications of coved will continue to act as such in years to come. Have I missed something?

Thanks for your comment Paul (and for getting to the end of a long article). I will develop this in part II as i look at the costs associated with football.

Was a fascinating read. Thank you.

Thanks mate, glad you enjoyed it

Paul, very thought provoking. There is a phrase currently being used all over the place-“The new normal” and I suspect, in line with this piece, football is going to have to invent its own version. Thanks

Thanks Ian, hope you and your family are safe and well. That’s the point really – will the people who still managed to spend every penny and more in the good times have the discipline and skills in the bad times. History suggests not. We will see!

Fantastic job mate. Gave me a great idea for my dissertation on Economics of Football. Appreciate it.