The arrival of Carlo Ancelotti at Everton has been accompanied by almost universal speculation that he has been provided with guarantees of a big transfer pot in which to shape his future squad.

As far as is possible, without getting too technical, I will try to explain the difficulties behind the assumption, then how possibly the situation can be mitigated.

Firstly, a quick look at how transfers in and out are calculated in accounting terms, then we need look at the regulatory restrictions currently surrounding the club and finally the treatment of further money poured into the club:

How transfers are accounted for:

We buy a player for £50 million, earning £5 million a year on a 5 year contract. How does that appear in the accounts?

The accounts take the transfer fee and spread it over the duration of the contract. So in this case the £50 million transfer fee is spread over 5 years creating a cost of £10 million a year (assuming no changes in contract length). Then his annual salary is added to the costs.

Thus in this case, the costs added to the profit and loss account each year for this player would be £15 million per annum.

If we sell a player then the treatment is slightly different. The profit or loss is calculated by calculating the price received for the player minus the remaining book value (remember in accounting terms the value of the player reduces each year as above)

So for example, a player bought for £20 million who is half way through his contract at Everton, but is sold for £30 million would generate a profit of £20 million in accounting terms (£30 million – £10 million). In addition, his future wages would obviously also disappear from future costs.

Everton’s current position:

Despite Moshiri’s capital injections in excess of £250 million, player trading profits approaching £200 million and extended credit facilities, the excesses and poor recruitment of the last 3.5 years has left Everton in a vulnerable position.

In order to understand our position and thus the likelihood of a large transfer pot for Ancelotti we must look at the Premier League rules surrounding loss-making clubs and assess our financial performance over the last three years including the current year 2019/20.

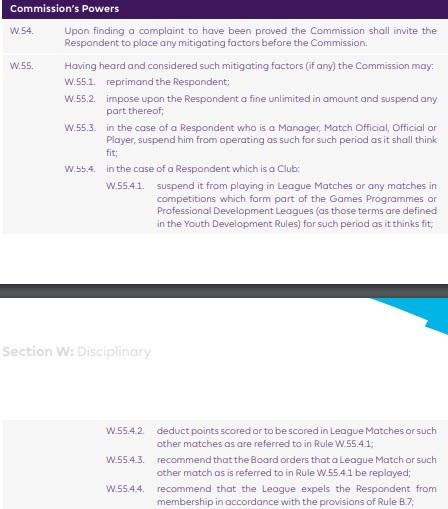

Profit & Sustainability Rules

These are the Premier League rules designed to keep a club from accumulating consistent and potentially unsustainable losses. They provide an explanation for what is included in the calculations and the consequences of breaking the limits.

The key figure is the maximum permitted losses amounting to £105 million over a three year period (including the current financial year) – rule E.59:

Adjusted Earnings

From the above definition the only costs that may be removed from the Profit & Sustainability calculations relate to women’s football expenditure, youth development expenditure (ie the academy) and any community development expenditure.

Other than the community development expenditure, Everton’s published accounts do not provide a breakdown of each figure.

Contrary to popular misconception the current costs associated with the development of Bramley-Moore charged to the profit and loss account are included in the Adjusted Earnings calculation. Currently for Everton, as until such a time as planning permission is granted these costs appear in the accounts as expenditure. Once planning permission is secured from an accounting point of view the costs are “capitalised” and the Profit & Loss account is adjusted for that purpose (i.e. the previously accounted expenses are added back in). Therefore currently those costs are included in the Premier League’s calculations.

How close to breaching rule E.59 are we?

At the time of writing the accounts for T-2 (2017/18) are published, T-1 (2018/19) are due to be published any day, and T is the current accounting period. Thus we need to look at projections for T-1 and T.

So before adjustment, actual and projected losses are as follows:

2017/18 : £13.07 million loss

2018/19: £95.00 million projected loss

2019/20: £35.00 million projected loss subject to any further player trading in and out.

Total projected losses for 3 years before adjustments: £143 million. It should be noted that my projection of losses in 2018/19 and this year are less than the projections of other similar analyses.

Regardless, that figure puts us well above the £105 million permitted losses even though the aggregate figure will be lower than £143 million because of the adjustments made for women’s football, the academy and community expenditures.

In addition, if planning permission is granted for Bramley-Moore before 30 June 2020 – the end of the current financial year) the accumulated costs to date (around £30-35 million) would therefore reduce the accumulated losses for the period.

Putting more funds into the club

So far we’ve not looked at how much cash is there to spend and how much cash (capital) will Moshiri be willing to put into the club to support Ancelotti.

Predicting the cash balance within the club is nigh on impossible particularly after at least one (possibly two) capital injection(s) by Moshiri in recent months and weeks. However it is fair to say that cash is limited and with current cash expenditure (wages, other operating costs and associated exceptional costs including Silva and Bramley-Moore) exceeding income, i.e. being cash flow negative, a continued and growing concern.

Some say that Moshiri will just continue to bankroll the club. Whilst him doing so would keep the club solvent and depending upon the scale of future investment provided funds for transfers (i) I think is extremely unlikely and (ii) doesn’t solve the profit and sustainability issues mentioned above. Capital injections do not solve the P&L account issues.

Why do I think it unlikely? Primarily due to the sums already invested and the future sums required for Bramley-Moore. Whilst a large element of the Bramley-Moore funding will be provided for by debt, a still substantial sum has to be raised from the majority shareholder. Additionally the primary lenders will wish to impose restrictions on Everton’s ability to spend over and above their income for a sustained period. (I will address the options for Bramley-Moore post the publication of the 2018/19 accounts).

What does this mean for Ancelotti (and indeed Brands)?

As things stand and assuming we wish to remain compliant with the Premier League rules, it is almost inconceivable that Ancelotti has a large transfer budget immediately available.

We have options though albeit relatively limited and/or undesirable.

We could choose to ignore the Premier League rules but the consequences of doing so may be wide and far reaching:

Alternatively, and I’ve mentioned it in previous podcasts, we can look to dispose of as many players as possible, not only including the “deadwood” to reduce the wage bill, but more effectively in the context of reducing losses, those players who we can sell at significant profits.

From a fans perspective, it hardly seems credible that selling some of your best players for profit is a wise strategy. However, it is consistently how the largest clubs operate when faced with costs leaping ahead of growth in income. Developing and selling assets to be re-invested in developing new assets is very much part of the modern game. With growth in income unlikely in the next few years, it remains our only viable compliant strategy. It also happens to be one of Brands’ primary areas of expertise.

Ancelotti at the age of 60 is entering a new phase of his career. Not only does he have to turn around a largely ailing club but he may have to do so by having a totally different operating practice in the transfer window.

The assumption that he is just going to spend big in this next window and the summer is flawed in my opinion. He has already said he needs time to become effective at Everton. That (in my opinion) will mean working with what he has and only very selective forays into the transfer market. Our financial performance will also highlight to him the very real need to be regular participants in European football.

The exciting part of this (and if you wish, the one shining light of hope) is that with Brands and Ancelotti we have two of the most intelligent senior executives in European football. We are in a tricky situation but at least we have, in Brands and Ancelotti, people who can plot a path to better times and for once, people with proven track records of success…..

Success which is likely to have to be earned rather than bought.

Categories: Everton finances

A somewhat stark but clear outline of where we are and how some perhaps need to calm down on their transfer speculation.

Thanks Paul, I’ve not read this as doom and gloom, more of a ‘let’s keep our feet on the ground’ and work the problems professionally and sensibly.

We’ve, or rather Moshiri, has thrown money at the problems to largely no avail… now we need to be calmer and probably more clinical in how we improve the squad to achieve the aim of long-term on-field improvement and sustainable involvement in Europe.

Paul, you use the word inconceivable in your piece and being honest, I find it inconceivable that Ancelotti has arrived here without some form of guarantee around transfer funds. Yes he’s a top top manager. Yes he’s earns that accolade from being an astute tactician, a clever man manager and his overall experience gives him a considerable edge. But he’s not achieved anything without having SOME money to spend and your analysis pretty much suggests that we can do one, or actually both, of two things.

Firstly, in terms of the rule around losses over 3 years at £105m, we could gamble on BMD planning permission pre 30th June. That might give us around £25m in January. Rather less exciting than most supporters expect when in truth we need about £100m worth of incoming.

Secondly, and now becoming increasingly clear, our only realistic option is sell to buy, again, not what the mass of our support expects. This follows your assertion that a possible mitigation is to sell and raise investment funds in a finely balanced piece of transfer accounting chess. Not only will we have to buy and sell in January…..a period known for its inflated prices and panic laden risk taking, but we will need to balance what is a very unpopular approach ie selling one, possibly two, of our top four or five players, and then buying in four or five replacements that somehow address quality and squad strategic needs, not to mention things like age and resale values. All very dull in terms of transfer excitement but sadly quite in line with the accounting / PL rule book / PFP.

The above feels to me to make sense yet again, I just cannot see how Ancelotti is here when he’s been told he has to lose the small amount of real quality we already have ?

Truth is in football terms I’m sensing most Evertonians will, a little surprisingly, accept the fact that a big overhaul is on the way and that means wheeling and dealing in ways that will feel uncomfortable. Richarlison out for £80m ? Tom Davies out for £20m? Plus take losses on Tosun (£10m in) Michael Keane (£15m in) and Morgan (£10m in) which only gives us £135m plus that BMD planning gamble to spend. £165m May give Ancelotti a bit of room but he’d have to gamble on youth as well. Holgate continuing his improvement. Moise Kean showing something, anything, and Anthony Gordon and a couple of others adding some depth to the squad.

So accounting and transfer wheeler dealing are the future. I sense it’s not the kind of analysis that improves your Twitter comments Paul, or mine probably !

Thanks for taking the time to comment Mark. One of the unfortunate aspects IMO, of Moshiri’s tenure is this view that rules don’t apply to us anymore. Sadly they do, and in Everton should the regulators wish to make an example, they have relatively low hanging fruit to pick.

A lot of the detail in your article went over my head, Paul (despite a course in doubles ledgering bookkeeping..!) but the bottom line facts seem indisputable and Ancelotti’s arrival becomes ever more exciting and fascinating. I have, like you, more faith and belief in him and Marcel Brands than any of the other managerial balls-ups we have had to watch. Neither of those men (nor too many other I’ve listened to) like the January window (who makes these decisions??) so, as we are some way off the pace, I’m looking forward to watching a smart man – two smart football men – deal with what is and await the figures, the AGM, the planning permission to give us a truer picture of EFC, than a cockamamie hope we’ll be cash splashing any time soon. By ALL means, shift the deadwood. With no disrespect to the athletes themselves, they are not good enough for the badge. Onwards!

As for adverse comment on social media – ignore!!!

Thanks Paul and Mark for your insightful comments. I think that offloading Richarlison to Man U (if they bite) at a big profit in January is part of the solution. This would enable us to bring in a couple of strong midfielders – why not on loan. Perhaps the club could also explore possible arrangements with USM to take some of the development costs off the club (ie bear the risk of planning permission being refused) perhaps in part-exchange for future naming rights. Also perhaps worth exploring the potential for some of the BMD expenditure to be treated in adjusted earnings as community development expenditure?

Interesting comments Rod thank you. I have asked previously re USM taking a risk position before planning approval and that was quickly dismissed.

The element of costs already incurred re the redevelopment of Goodison Park are already being used to adjust earnings in line with the regulations regarding community development.

One other point others may miss (not you of course) is the leverage you get from from a profitable sale – i.e. assume for argument’s sake we make £45m on Richarlison, assuming we have the debt financing, this covers amortisation over the next three years of signings worth £75m with 5 year contracts.